Eela Dubey started to construct the thesis for her company by asking a simple question — one that had been asked a million times before:

“Education can and should be a universal right. If we want to focus on global change, it’s by educating our future generations. Why should a price tag stop that?”

As someone who once had to drop out of a masters programme at Columbia University because she could not afford the school tuition, Eela realised there must be others in a similar boat. Falling back on her experience on Wall Street as a financier, and merging it with something that gave her purpose, she founded EduFund— a startup that helps parents and kids plan for higher education and instil the importance of saving and investing.

Education funds are a relatively new concept in India. Most Indian households tend to set aside a fixed sum, usually in the form of a fixed deposit, for their children — but these are not well-planned savings. They’re mostly arbitrary amounts, deposited into the kitty a couple of times, and invested in instruments that tend to attract nominal interest rates.

Eela wanted to change that, especially after she realised the impact education could have in the real world, thanks to the time she spent working with children in Mumbai’s Dharavi and SAMPARC, an NGO.

The startup, incepted in 2020 by Eela and Arindam Sengupta in February, has so far raised Rs 2.5 crore as part of a pre-seed investment round led by View Trade Holding Corp.

Making smarter education choices

Quality higher education in India, and the world, is quite expensive, costing anywhere between Rs 2 lakh to Rs 25 lakh, per annum. For more middle-class Indian households, the price tag places access to higher education out of reach.

On top of tuition fees, other expenses like food, accommodation, transportation, groceries, etc, also add to the financial burden parents often have to bear.

“Today, the single biggest roadblock Indian parents face is financing their child’s higher education. Indian children don’t lack aptitude. Rather, they lack financing resources. This was a struggle that personally resonated with me,” Eela says

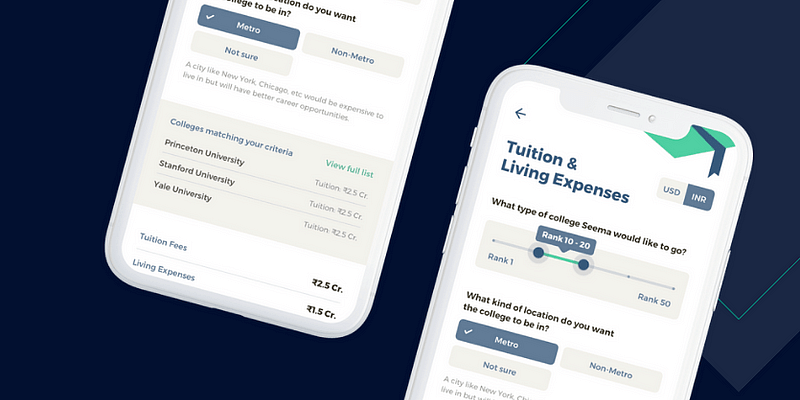

EduFund solves that problem by helping parents plan for such expenses in advance. Parents can use the platform to create a concrete roadmap of what the expenses for their child’s higher education could look like; get insights into other outages, such as cost of living, inflation, foreign exchange fluctuations, etc that could impact their overall expenditure; and what investment instruments — mutual funds, ETFs, insurance policies, bonds etc — they could tap to help them increase their wealth.

“Our college calculator arms parents with the knowledge of cost. We then help parents understand which investments best suit their goals to reach this savings target,” Eela says. The investment recommendations the EduFund app throws up are backed by thorough research and data, she adds.

The second service the startup provides is counselling — an important part of preparing for higher education, especially for colleges abroad.

Harnessing EduFund’s partner network comprising top education counsellors and exam-prep companies, students can get a holistic understanding of the right stream for them, their prospects in those educational streams, top universities that offer quality education, the admissions process, and applications and tests they may need to get in.

That not only helps the child plan their own educational future, but also gives more visibility to the parents in terms of finances.

“Education is a defined event — if you have a child there is a high probability it will happen, and it will happen at a specific time. My vision for EduFund is to make a companion for parents that helps them with the entire planning journey for their child’s higher education — financing and counselling,” Eela says.

The Ahmedabad-based startup said its app has seen around 6,500 downloads, so far, and more than 1,500 registered users have been using the platform to interact with counsellors. The company has struck deals with several education consultants such as OnCourse Global, Zsoldos Coaching, Reva Education Consultant, and Overseas Education Consultancy.

Its biggest competitors include banks, which offer recurring deposit services that allow depositors to save towards a specified goal of their choosing, which they can then use to invest in instruments of their choice, and other services that offer regular savings and investments. In the startup space, EduFund has created a niche for itself, where it doesn’t compete with too many others, especially when it comes to offering education-specific financial planning, including calculating the overall education fees, cost of living expenses., etc, and counselling services.

The education planning and finance industry (including counselling, immigration, testing etc) is worth roughly $28 billion, growing at a CAGR of up to 20 percent.

With 250 million school-going children — more than any other country — as well as moderate to high enrolment ratios, a blurring of geographical boundaries, and easier access to loan instruments for funding, the education services sector is projected to grow substantially in the coming years.