Pushed towards change by evolving consumer preferences and rapid digitisation due to the coronavirus-induced lockdowns, SMBs now seek digital transformation for their businesses.

According to a report by RedSeer Consulting, digital payments in India are expected to grow over three-fold to Rs 7,092 trillion by 2025 from Rs 2,162 trillion in 2019-20. The report attributes government policies around financial inclusion and growing digitisation of merchants as primary factors for the growth.

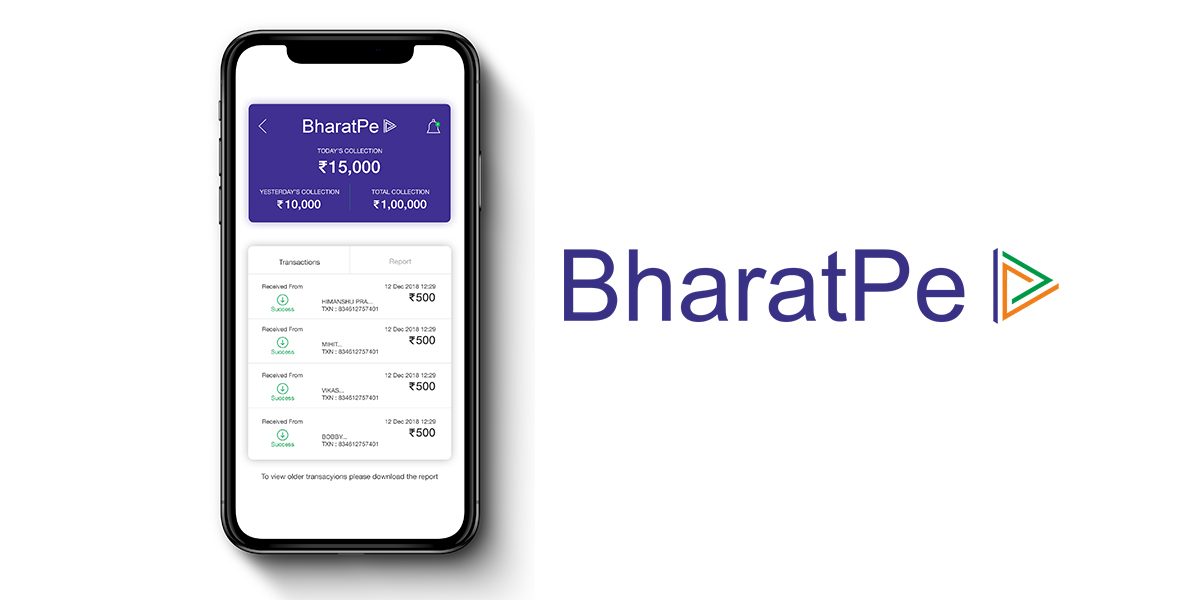

About BharatPe BharatPe

has emerged as a leading fintech solution for SMBs to collect UPI payments through multiple payment apps in India.

Started in March 2018 by Ashneer Grover and Shashvat Nakrani, the fintech startup offers a portfolio of products to help merchants accept digital payments through QR codes that support government-backed UPI payments infrastructure.

It launched one of India’s first interoperable UPI QRs with zero transaction fees, and has seen manifold grown over the last couple of years. It offers a host of fintech products, including a range of loans for small businesses, POS/card swipe machines for card payment acceptance, insurance, and digital gold.

How SMBs can start using BharatPe To begin their journey on BharatPe, SMBs need to follow these steps:

1. Initial registration: Download BharatPe app on your mobile phone from Google Play Store for Android or the App Store for iOS, and select the preferred language. Add your business mobile number and verify it with the OTP.

2. Add your bank account: After you have verified your phone number, either choose your bank or fill in your bank details including IFSC code and account number. Once you have verified your bank account, it will get linked to the BharatPe app.

3.Register your business: After linking your bank account, enter the name of your shop, company, or business and select the correct business category. In case you don’t find your category listed, select the ‘Other/Miscellaneous’ option and fill in your business category. Thereafter, select ‘Permanent (immovable)’ or ‘Temporary (movable)’ shop type and then proceed next to complete the registration.

4. Get your QR code: Now enter your business address and order your BharatPe QR code kit. You can also download your digital QR code. This will help you to accept payments from your customers without any charge. As soon as you enter the address, a request for your QR kit will be processed.

5. Receive your QR kit and begin accepting payments: You will receive a BharatPe QR kit which includes a personalised and ready-to-use QR code, as well as a ‘BharatPe accepted here’ sticker with all the UPIs. Paste your QR sticker at an easily accessible place in front of your shop for customers to scan and pay.

Advantages of using BharatPe

Some advantages of using BharatPe include the ability to accept payments from any UPI app, zero transaction fees, the option to avail collateral-free business loans through the app, and more.

The app currently has a 4.2/5 rating on Google Play Store, with users largely giving positive reviews.

However, the app occasionally suffers from blank loading screens, according to some online reviews. To date, the app has benefitted around six million merchants across Tier I to Tier IV cities in India with its payment solution and credit support services, claims BharatPe.